Highlights:

- Electric vehicles lose the most value after purchase, falling 58.8% in 5 years

- Trucks and hybrids retain the most value, losing 40.4% and 40.7%, respectively

- Sports cars and small SUVs like the Porsche 911 and 718 Cayman, Chevrolet Corvette, Toyota RAV4, and Honda CR-V dominate the top 25 rankings for cars that retain value

- Electric vehicles and luxury models like the Jaguar I-PACE, BMW 7 Series, Tesla Model S, and Nissan LEAF make up 23 of the 25 cars that lose the most value

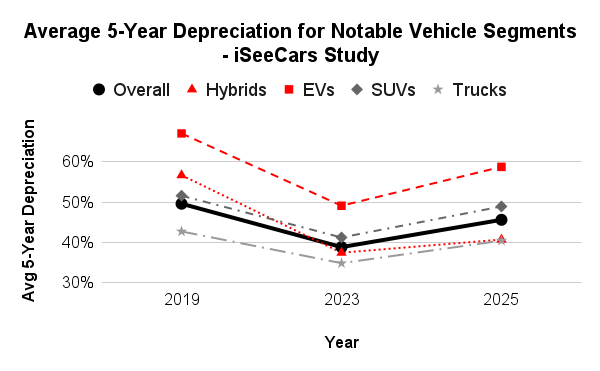

- Every vehicle type is losing more value in 2025 than they did in 2023, but hybrids have remained the closest to the value retention peaks every segment experienced during the pandemic

Used car prices have dropped since their peak during the pandemic, as reflected in higher 5-year depreciation rates across all vehicle types. This means new cars are losing more money after 5 years because both the new and used car supply is slowly returning to normal following the plant shutdowns during COVID.

But the rate of depreciation varies drastically between segments, with electric vehicles now losing 58.8% of their value after 5 years, and trucks and hybrids only losing about 40% of their new vehicle value. The industry average for all vehicles is 45.6%, reflecting more lost value than the 38.8% drop in 2023, but less than the 49.6% drop in 2019.

iSeeCars analyzed over 800,000 5-year-old used cars sold from March 2024 to February 2025 to determine 5-year depreciation rates.

| 5-Year Depreciation for Notable Vehicle Segments - iSeeCars Study | |||

| Segment | 2019 | 2023 | 2025 |

| Overall | 49.6% | 38.8% | 45.6% |

| Hybrids | 56.7% | 37.4% | 40.7% |

| EVs | 67.1% | 49.1% | 58.8% |

| SUVs | 51.6% | 41.2% | 48.9% |

| Trucks | 42.7% | 34.8% | 40.4% |

“Depreciation remains the most expensive aspect of buying a new vehicle, and the variation between vehicle types and specific models is something consumers should consider when researching their next purchase,” said iSeeCars Executive Analyst Karl Brauer. “The difference between buying a hybrid versus an electric vehicle could be tens of thousands of dollars in lost value.”

Top 25 Vehicles with the Lowest 5-Year Depreciation

The Porsche 911 and 718 Cayman lose the least value after 5 years, followed by the Toyota Tacoma, Chevrolet Corvette, and Honda Civic. Looking at the top 25 cars there’s a recurring theme of sports/performance models and small SUVs, with a few trucks and sedans also making the list.| Top 25 Vehicles with the Lowest 5-Year Depreciation - iSeeCars Study | ||||

| Rank | Model | Segment | Average 5-Year Depreciation | Average $ Difference from MSRP |

| 1 | Porsche 911 | Sports Car | 19.5% | $24,428 |

| 2 | Porsche 718 Cayman | Sports Car | 21.8% | $15,851 |

| 3 | Toyota Tacoma | Truck | 26.0% | $8,217 |

| 4 | Chevrolet Corvette | Coupe | 27.2% | $18,557 |

| 5 | Honda Civic | Sedan/Hatchback | 28.0% | $6,987 |

| 6 | Chevrolet Camaro | Sports Car | 28.0% | $8,653 |

| 7 | Toyota Tundra | Truck | 29.1% | $11,659 |

| 8 | Ford Mustang | Sports Car | 29.2% | $9,325 |

| 9 | Porsche 718 Boxster | Sports Car | 29.6% | $22,155 |

| 10 | Toyota Corolla Hatchback | Hatchback | 30.1% | $7,156 |

| 11 | Subaru BRZ | Sports Car | 30.2% | $9,424 |

| 12 | Toyota RAV4/RAV4 Hybrid | SUV/Hybrid | 30.9% | $9,233 |

| 13 | Toyota 4Runner | SUV | 31.3% | $12,753 |

| 14 | Toyota Corolla | Sedan | 31.4% | $7,004 |

| 15 | Subaru Crosstrek | SUV | 33.0% | $8,511 |

| 16 | Subaru Impreza | Wagon | 33.4% | $7,889 |

| 17 | Chevrolet Corvette | Sports Car | 33.7% | $25,343 |

| 18 | Jeep Wrangler | SUV | 33.9% | $10,888 |

| 19 | Honda HR-V | SUV | 34.0% | $8,640 |

| 20 | Ford Ranger | Truck | 34.7% | $11,472 |

| 21 | Honda Accord | Sedan | 34.9% | $9,879 |

| 22 | Toyota Prius | Hybrid | 34.9% | $9,908 |

| 23 | Honda CR-V | SUV | 35.2% | $10,602 |

| 24 | Subaru WRX | Sedan | 35.5% | $12,702 |

| 25 | Toyota Camry | Sedan | 35.5% | $9,388 |

| Overall Average | 45.6% | $17,395 | ||

Top 25 Vehicles with the Highest 5-Year Depreciation

Premium models typically lose more value than mainstream models, as confirmed in this year’s list of new vehicles that lose the most value after 5 years. A high number of electric vehicles also make the list, with Jaguar’s I-PACE losing more value than any other vehicle, and the Tesla Model S, Nissan LEAF, and Tesla Model X among the vehicles with the largest rate of depreciation.| Top 25 Vehicles with the Highest 5-Year Depreciation - iSeeCars Study | ||||

| Rank | Model | Segment | Average 5-Year Depreciation | Average $ Difference from MSRP |

| 1 | Jaguar I-PACE | EV | 72.2% | $51,953 |

| 2 | BMW 7 Series | Sedan | 67.1% | $65,249 |

| 3 | Tesla Model S | EV | 65.2% | $52,165 |

| 4 | INFINITI QX80 | SUV | 65.0% | $53,571 |

| 5 | Maserati Ghibli | Sedan | 64.7% | $70,874 |

| 6 | BMW 5 Series | Hybrid | 64.7% | $47,457 |

| 7 | Nissan LEAF | EV | 64.1% | $18,043 |

| 8 | Maserati Levante | SUV | 63.7% | $64,991 |

| 9 | Tesla Model X | EV | 63.4% | $53,846 |

| 10 | Cadillac Escalade ESV | SUV | 62.9% | $56,996 |

| 11 | Land Rover Range Rover | SUV | 62.9% | $67,858 |

| 12 | Audi A8 L | Sedan | 62.7% | $57,724 |

| 13 | BMW 5 Series | Sedan | 61.7% | $36,208 |

| 14 | Audi Q7 | SUV | 61.6% | $37,256 |

| 15 | INFINITI QX60 | SUV | 61.5% | $30,888 |

| 16 | Cadillac Escalade | SUV | 61.0% | $53,458 |

| 17 | Audi A6 | Sedan | 60.9% | $35,401 |

| 18 | Land Rover Discovery | SUV | 60.9% | $36,635 |

| 19 | Mercedes-Benz S-Class | Sedan | 60.7% | $71,460 |

| 20 | Audi A7 | Sedan | 60.5% | $43,535 |

| 21 | Tesla Model Y | EV | 60.4% | $36,225 |

| 22 | Lincoln Navigator L | SUV | 60.3% | $62,069 |

| 23 | Porsche Taycan | EV | 60.1% | $59,691 |

| 24 | Nissan Armada | SUV | 60.0% | $33,914 |

| 25 | Ford Expedition MAX | SUV | 60.0% | $36,692 |

| Overall Average | 45.6% | $17,395 | ||

Electric Vehicles Ranked by Depreciation

Only two electric vehicles, the Tesla Model 3 and Hyundai Kona Electric, are above the 58% average for EV depreciation. Electric vehicles were still pretty uncommon 5 years ago, but within this group the Jaguar I-PACE ranks the worst by losing more than 72% of its value.| EVs Ranked by 5-Year Depreciation - iSeeCars Study | |||

| Rank | Model | Average 5-Year Depreciation | Average $ Difference from MSRP |

| Overall Average | 45.6% | $17,395 | |

| 1 | Tesla Model 3 | 55.9% | $23,771 |

| 2 | Hyundai Kona Electric | 58.0% | $19,062 |

| EV Average | 58.8% | $29,356 | |

| 3 | Kia Niro EV | 59.2% | $23,439 |

| 4 | Porsche Taycan | 60.1% | $59,691 |

| 5 | Tesla Model Y | 60.4% | $36,225 |

| 6 | Tesla Model X | 63.4% | $53,846 |

| 7 | Nissan LEAF | 64.1% | $18,043 |

| 8 | Tesla Model S | 65.2% | $52,165 |

| 9 | Jaguar I-PACE | 72.2% | $51,953 |

Hybrid Vehicles Ranked by Depreciation

Hybrid vehicles are among the best segments for retained value, losing just 40.7% after 5 years. Toyota dominates the rankings with seven models above the segment average.| Hybrids Ranked by 5-Year Depreciation - iSeeCars Study | |||

| Rank | Model | Average 5-Year Depreciation | Average $ Difference from MSRP |

| 1 | Toyota RAV4 Hybrid | 31.2% | $10,062 |

| 2 | Toyota Prius | 34.9% | $9,908 |

| 3 | Toyota Corolla Hybrid | 35.6% | $8,471 |

| 4 | Toyota Prius Prime | 36.0% | $11,865 |

| 5 | Toyota Highlander Hybrid | 39.8% | $18,432 |

| 6 | Toyota Camry Hybrid | 39.8% | $11,486 |

| 7 | Lexus UX 250h | 39.8% | $14,156 |

| Hybrid Average | 40.7% | $14,758 | |

| 8 | Honda Accord Hybrid | 41.1% | $13,834 |

| 9 | Honda CR-V Hybrid | 41.3% | $14,301 |

| Overall Average | 45.6% | $17,395 | |

| 10 | Kia Niro | 46.8% | $12,630 |

| 11 | Lexus ES 300h | 47.6% | $20,666 |

| 12 | Kia Niro Plug-In Hybrid | 47.6% | $16,412 |

| 13 | Hyundai Sonata Hybrid | 48.6% | $15,186 |

| 14 | Porsche Cayenne | 52.1% | $50,607 |

| 15 | Ford Escape Hybrid | 52.3% | $17,000 |

| 16 | Mitsubishi Outlander PHEV | 53.4% | $21,609 |

| 17 | Mercedes-Benz GLC | 54.3% | $32,552 |

| 18 | Volvo XC60 | 57.4% | $33,316 |

| 19 | BMW 5 Series | 64.7% | $47,457 |

Trucks Ranked by Depreciation

Trucks hold their value better than any other vehicle type, with Toyota’s Tacoma and Tundra topping the list, followed by the Ford Ranger, Jeep Gladiator, GMC Canyon, and Nissan Frontier all ranking above the segment’s 40.4% average.| Trucks Ranked by 5-Year Depreciation - iSeeCars Study | ||||

| Rank | Model | Size | Average 5-Year Depreciation | Average $ Difference from MSRP |

| 1 | Toyota Tacoma | Midsize | 26.0% | $8,217 |

| 2 | Toyota Tundra | Full-size | 29.1% | $11,659 |

| 3 | Ford Ranger | Midsize | 34.7% | $11,472 |

| 4 | Jeep Gladiator | Midsize | 35.6% | $13,558 |

| 5 | GMC Canyon | Midsize | 38.1% | $14,644 |

| 6 | Nissan Frontier | Midsize | 38.3% | $12,284 |

| Truck Average | 40.4% | $15,114 | ||

| 7 | Chevrolet Colorado | Midsize | 40.9% | $13,050 |

| 8 | Chevrolet Silverado 1500 | Full-size | 41.5% | $15,367 |

| 9 | GMC Sierra 1500 | Full-size | 41.6% | $15,949 |

| 10 | Honda Ridgeline | Midsize | 42.4% | $17,013 |

| 11 | Ram 1500 | Full-size | 42.8% | $17,241 |

| 12 | Ford F-150 | Full-size | 43.4% | $16,236 |

| Overall Average | 45.6% | $17,395 | ||

| 13 | Nissan Titan XD | Full-size | 47.9% | $25,306 |

| 14 | Nissan Titan | Full-size | 48.1% | $22,459 |

| 15 | Ram 1500 Classic | Full-size | 48.1% | $18,634 |

Top 5 Small SUVs with the Lowest 5-Year Depreciation

Small SUVs like the Toyota RAV4, Honda CR-V, and Subaru Forester are among the best-selling vehicles in the new car market. The demand for these models remains strong in the used market, as reflected in their high residual values.| Top 5 Small SUVs with the Lowest 5-Year Depreciation - iSeeCars Study | |||

| Rank | Model | Average 5-Year Depreciation | Average $ Difference from MSRP |

| 1 | Toyota RAV4/RAV4 Hybrid | 30.9% | $9,233 |

| 2 | Subaru Crosstrek | 33.0% | $8,511 |

| 3 | Honda HR-V | 34.0% | $8,640 |

| 4 | Honda CR-V | 35.2% | $10,602 |

| 5 | Subaru Forester | 37.9% | $11,378 |

| Small SUV Average | 45.5% | $14,549 | |

Top 5 Small SUVs with the Highest 5-Year Depreciation

Electric models make up three of the top 5 small SUVs with the highest rate of depreciation, and all of these vehicles lose more than 59% of their value after 5 years.| Top 5 Small SUVs with the Highest 5-Year Depreciation - iSeeCars Study | |||

| Rank | Model | Average 5-Year Depreciation | Average $ Difference from MSRP |

| 1 | Jaguar I-PACE | 72.2% | $51,953 |

| 2 | Tesla Model Y | 60.4% | $36,225 |

| 3 | Jaguar F-PACE | 59.8% | $34,113 |

| 4 | Cadillac XT5 | 59.6% | $26,398 |

| 5 | Kia Niro EV | 59.2% | $23,439 |

| Small SUV Average | 45.5% | $14,549 | |

Top 5 Midsize SUVs with the Lowest 5-Year Depreciation

The midsize SUV category is another popular segment, with the top-ranked Toyota 4Runner’s value down just 31.3% after 5 years and all of the top five models well above the segment average of 51.2%.| Top 5 Midsize SUVs with the Lowest 5-Year Depreciation - iSeeCars Study | |||

| Rank | Model | Average 5-Year Depreciation | Average $ Difference from MSRP |

| 1 | Toyota 4Runner | 31.3% | $12,753 |

| 2 | Jeep Wrangler | 33.9% | $10,888 |

| 3 | Toyota Highlander/Highlander Hybrid | 42.1% | $17,023 |

| 4 | Lexus RX 350 | 42.7% | $20,914 |

| 5 | Honda Passport | 46.3% | $20,730 |

| Midsize SUV Average | 51.2% | $22,008 | |

Top 5 Midsize SUVs with the Highest 5-Year Depreciation

Luxury models commonly lose the most value after 5 years, with all these SUVs experiencing more than 60% depreciation compared to the segment average of 51%.| Top 5 Midsize SUVs with the Highest 5-Year Depreciation - iSeeCars Study | |||

| Rank | Model | Average 5-Year Depreciation | Average $ Difference from MSRP |

| 1 | Maserati Levante | 63.7% | $64,991 |

| 2 | Tesla Model X | 63.4% | $53,846 |

| 3 | Audi Q7 | 61.6% | $37,256 |

| 4 | INFINITI QX60 | 61.5% | $30,888 |

| 5 | Land Rover Discovery | 60.9% | $36,635 |

| Midsize SUV Average | 51.2% | $22,008 | |

Top 5 Large SUVs with the Lowest 5-Year Depreciation

Large SUVs mean both a big purchase price up front and big value loss after 5 years. But models like the Mercedes-Benz G-Class, GMC Yukon, and Chevrolet Tahoe can mitigate the losses.| Top 5 Large SUVs with the Lowest 5-Year Depreciation - iSeeCars Study | |||

| Rank | Model | Average 5-Year Depreciation | Average $ Difference from MSRP |

| 1 | Mercedes-Benz G-Class | 38.8% | $57,548 |

| 2 | GMC Yukon | 52.4% | $35,032 |

| 3 | Chevrolet Tahoe | 52.6% | $27,601 |

| 4 | Chevrolet Suburban | 55.6% | $34,166 |

| 5 | Lincoln Aviator | 55.9% | $32,140 |

| Large SUV Average | 57.3% | $39,454 | |

Top 5 Large SUVs with the Highest 5-Year Depreciation

Most of the large SUVs with the highest depreciation rates are luxury models, but Nissan’s Armada also makes the list due to its aging design, which was finally refreshed for 2025.| Top 5 Large SUVs with the Highest 5-Year Depreciation - iSeeCars Study | |||

| Rank | Model | Average 5-Year Depreciation | Average $ Difference from MSRP |

| 1 | INFINITI QX80 | 65.0% | $53,571 |

| 2 | Land Rover Range Rover | 62.9% | $67,858 |

| 3 | Cadillac Escalade/Escalade ESV | 61.8% | $54,886 |

| 4 | Lincoln Navigator L | 60.3% | $62,069 |

| 5 | Nissan Armada | 60.0% | $33,914 |

| Large SUV Average | 57.3% | $39,454 | |

Car buyers should use this list to either purchase a new vehicle with low depreciation, or consider a high depreciation model offering big savings on the used market.

Methodology

iSeeCars analyzed over 800,000 5-year-old used cars sold from March 2024 to February 2025. Heavy-duty trucks and vans, models no longer in production as of the 2024 model year, and low-volume models were removed from further analysis. MSRPs were inflation-adjusted to 2025 dollars based on data from the US Bureau of Labor Statistics. The difference in average asking price for each vehicle between its MSRP and its used car pricing was mathematically modeled to obtain the vehicle’s depreciation.

About iSeeCars.com