You’re about to start the car buying process. Which likely means you’re asking yourself that eternal question: What should I do with my used car? Sell it, or trade it in?

There are advantages to both. If you have an exceptionally clean vehicle that has well over the normal number of miles on it, you may do better trying to sell the car yourself, as high mileage works against trade-in value at a dealership. Conversely, if your current car is on the junky side, you might find a buyer who doesn’t care as much about that as a new-car dealership does.

But then you’d be going through the hassle of putting your used car on the market and dealing with car buyers who may or may not have a genuine interest in buying. It’s simpler and easier to trade in your old car, but you’ll still need to do some prep work to make sure you are getting the highest trade-in value. You might also consider selling your car to CarMax or Carvana, as they will quickly determine the value of your used car and offer a purchase price. The money they provide can help you eliminate any loan balance you may have on your current car, and ideally provide you with a full down payment for your new car.

Determining the Value of Your Car

The process of trading in your car starts with determining how much your car is worth. First, take a hard look at your vehicle, eliminating any personal positive or negative feelings that may have arisen over the years. Is it too small? Not for somebody needing a small car. Too big? Somebody needs that carrying capacity. Too thirsty? A matter of opinion. The wrong color? See “too thirsty.” None of those are legitimate factors regarding trade-in value.

Factors that are legit: How many miles? The lower the better. How clean is it? It should be as clean as you can get it, or lacking that, have it professionally detailed – never try to trade in, or for that matter sell to a private party, a vehicle that needs a bath, a vacuuming, or has overflowing ashtrays. You’d be surprised at how many people ignore that advice and pay for it in reduced trade-in value for their current car.

So, what kind of shape is your old car in? Be honest. There may be great sentimental value in the fact that your third child was born in the back seat, but it doesn’t raise the value of the car. You must be clinical about valuing your trade-in. And don’t take it personally if a salesperson test-drives your car and proceeds to tell you everything that’s wrong with it. He or she may be setting you up to take less than it’s worth, but if you’ve done your research, hold your ground.

Several websites, including Edmunds (Edmunds.com) and Kelley Blue Book (kbb.com) have valuation tools that will give you a ballpark estimate on the value of your car. Again, be honest – you might be able to overlook some small rips in the upholstery, but a buyer or dealer won’t. Some valuation tools offer an estimate specifically for trade-in value, but that’s just what it is – an estimate.

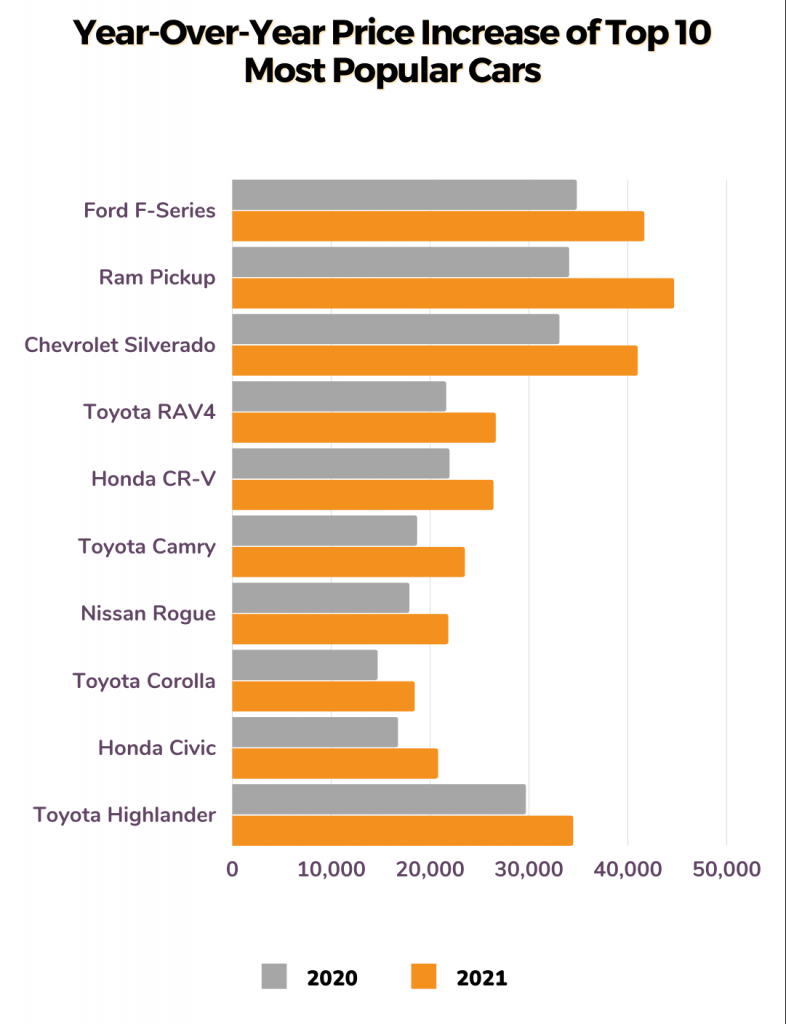

It’s worth noting that used car depreciation hasn’t followed normal patterns recently. Average used car values have actually gone up by approximately 30 percent in the past 15 months, which means your car is likely worth more than you think. iSeeCars has reported on used car price trends in recent months, and below we’ve listed the rise in value on the 10 most popular cars in today’s market.

It’s also worth searching sites like craigslist.com or iseecars.com for used vehicles like yours to see what the asking prices are. Give yourself a spread of a few years, such as searching for 2011-2013 Ford Explorers, if yours is a 2012. Subtract 10-15 percent off the asking price, and that is more than likely the real-world price of the car when it changes ownership.

What’s Your Auto Loan Status?

Also worth researching is the value of your trade-in versus what, if anything, you owe on it, also known as your loan balance. Hopefully your loan amount is lower than the value of your car, meaning you have “positive equity”. You can trade in a vehicle you are “upside-down” on, meaning you owe more than it is worth, or have “negative equity”. But the payoff amount for your old loan will be deducted from what you are offered by the dealership.

Almost all vehicles depreciate, save those handful that are worth more used than you paid for them new. However, some cars hold their value better than others. A dealer may offer to add the extra money needed for paying off your old vehicle by “rolling over” the negative equity into the new car loan terms, which can be a problem, as this can continue the cycle of having negative equity on your new loan, just as you may on your current loan. And if you have a low credit score or bad credit, the lender will most likely offer less desirable loan terms, including a higher interest rate that can translate into higher monthly payments.

This is the perfect time to carefully consider the predicted resale value of your next vehicle. While nobody likes to think about getting rid of the vehicle they are about to purchase, the reality is that you will eventually be selling or trading in your next car just like you’re trading in your current car. Utilize iSeeCars’ current studies on vehicles that depreciate the least, and most, to identify a model that will hold its value the best, thus giving you more value toward the next vehicle you buy when you’re done with this one.

Trading In Your Car for a New or Used Car?

When it comes time to trade your current vehicle in, think hard about whether you need a brand-new car, or if you really just want something that’s a few years newer than what you have. Used-car dealerships will also give you a trade-in value as part of a new (to you) used car purchase, but you can’t necessarily expect to get as much for your car as you would dealing for a new vehicle. New-car dealers always have a used-car lot, typically populated by very clean vehicles. Used vehicles that are “certified,” meaning they have been inspected closely and may even have a warranty, are the most expensive used cars at a new-car dealership, though they may be worth it. (Check out our handy guide for more on what certified pre-owned means.And as for that new vehicle: On the majority of cars, you can expect some discount off sticker price, sometimes in the form of factory or dealer incentives. It might be a very small discount if you’re hankering for a hot seller, or a bigger discount if it’s a slower-selling model. If there’s a rebate of more than $500, or zero-percent financing is offered, odds are the vehicle is not selling like hotcakes. Ideally you should get the full trade-in value of your car, plus a discount off the new car list price. Even no-haggle dealers will usually haggle over trade-in value if it means making a sale. Also remember that you don’t have to buy a vehicle to utilize your trade-in vehicle; trade-ins are accepted when leasing a car, too.

Remain Vigilant Throughout the Buying Process

It doesn’t matter whether you’re buying a car outright or leveraging your current car as a trade-in, always shop around and take special notice of dealership add-ons that raise the sticker price beyond what the manufacturer suggests. There’s a reason they call it “suggested retail price” – new car dealerships can charge whatever they want. If you are offered well over what your trade-in is really worth, the dealership might try to get it back by charging more for the vehicle you are buying. Always focus on the difference between what the dealer is giving you for trade-in value and the agreed purchase price of the car you’re buying.

After you negotiate your best car price, beware the person in the nice glass office who actually closes the deal. He or she may try to upsell you on accessories, pinstriping, undercoating, an extended warranty, bigger wheels and tires, insurance on the loan itself, a higher interest-rate loan, a longer payback schedule, a lower-than-discussed trade-in value for your car, and anything else that will boost the dealer’s bottom line.

Shoppers often assume once a purchase price is set, and a trade-in value is agreed to, the deal is done. But the deal isn’t done until all the paperwork is signed, and you have to examine added costs closely as the deal is finalized. Sales tax and registration costs are unavoidable, and some “documentation” charges make sense, though you should ask the dealership about every one of them to confirm what you’re paying for.

Remember this: They are professional car sellers. You are an amateur car buyer. If you are easily swayed or aren’t confident you can swing the best deal, take along that car-nut friend who has likely been through this car shopping process a lot and understands the nuances – someone who, unemotionally, can say “no” if the deal isn’t a very good deal.

More Car Buying Advice:

- How to Buy a Used Car

- What to Look For When Buying a Used Car

- Most Reliable Cars

- How to Get a Car Loan