Highlights:

- In both the new and used car markets, EVs sell the slowest while hybrids sell the fastest

- The Toyota Highlander Hybrid is the fastest-selling new car at 14.2 days on market, followed by the Mercedes-Benz G-Class and Land Rover Range Rover

- The Lexus RX 350h is the fastest-selling used car at 12.3 days on market, followed by the Lexus NX 350h and Lexus NX 250

- Six of the 20 fastest-selling new cars are hybrids, with one EV making the list

- Eight of the 20 fastest-selling used cars are hybrids, with no EVs on the list

After years of limited supply and rapid turnover, new cars are now languishing on dealer lots. The average new car sells in 54 days, while new EVs take 70.6 days and new hybrids sell in 49.5 days, according to a recent study by iSeeCars.

The analysis of 463,000 new and used car sales from March 2024 found a 21.6 percent slowdown in average days on market for new cars compared to a 30.5 percent increase for used cars.

“Between the gradual drop in new car pricing and consistent slow-down in their sales pace, it’s like watching a giant machine slowly wind down,” said Karl Brauer, iSeeCars Executive Analyst. “New cars are still more expensive than before Covid, and they’re still selling at a reasonable rate, but the pendulum has clearly swung the other direction.”

Days on Market By Fuel Type

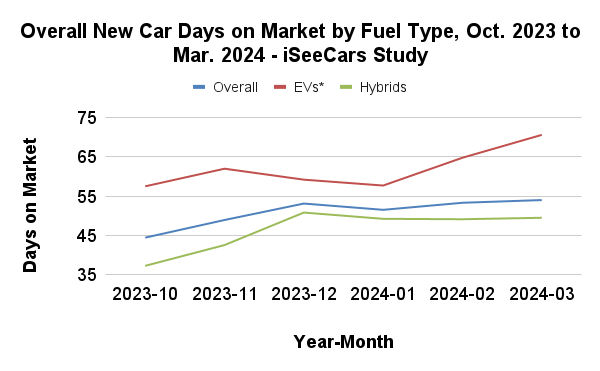

New Car Days To Sell Over the Past Six Months

The new car sales pace continues to slow, a reflection of rising interest rates and reduced consumer spending power due to inflation. These same forces have had an even bigger impact on the electric vehicle sales pace, even as hybrids maintain a roughly 20-day advantage over EVs.| Monthly Average Days on Market for New Cars by Fuel Type - iSeeCars Study | ||||

| Year | Month | Overall | EVs* | Hybrids |

| 2023 | October | 44.4 | 57.5 | 37.2 |

| 2023 | November | 48.9 | 62.0 | 42.5 |

| 2023 | December | 53.1 | 59.2 | 50.8 |

| 2024 | January | 51.5 | 57.7 | 49.2 |

| 2024 | February | 53.3 | 64.8 | 49.1 |

| 2024 | March | 54.0 | 70.6 | 49.5 |

“The average new car and new hybrid have stabilized at around 50 days to sell over the past 4 months,” said Brauer. “But fading electric vehicle demand is reflected in a slowing sales rate that’s now passed 70 days, despite EV production cuts across several automakers.”

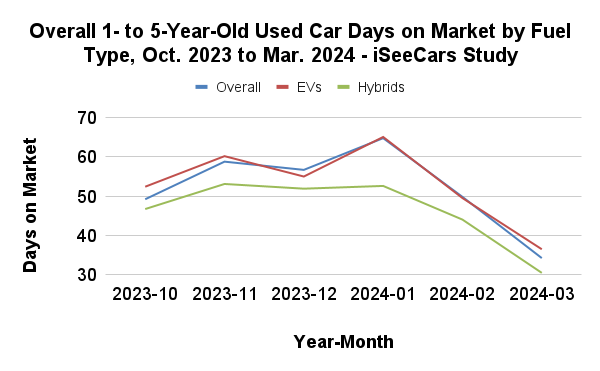

Used Car Days To Sell Over the Past Six Months

In stark contrast to new cars, used cars are picking up speed, selling in 34.2 days which is nearly twice as fast two months ago, likely spurred by tax returns as the used car buying season ramps up. As with new EVs, used EVs are selling slower than average, but only slightly slower at 36.4 days. Used hybrids are once again outpacing the average used car, selling in 30.4 days.| Monthly Average Days on Market for 1- to 5-Year-Old Used Cars by Fuel Type - iSeeCars Study | ||||

| Year | Month | Overall | EVs | Hybrids |

| 2023 | October | 49.2 | 52.4 | 46.7 |

| 2023 | November | 58.8 | 60.2 | 53.1 |

| 2023 | December | 56.7 | 55.0 | 51.9 |

| 2024 | January | 64.8 | 65.1 | 52.6 |

| 2024 | February | 49.8 | 49.5 | 44.0 |

| 2024 | March | 34.2 | 36.4 | 30.4 |

Days on Market for New Cars

The 20 Fastest-Selling New Cars

Consumers are slower to buy new cars, but those buying are seeking maximum value.| 20 Fastest-Selling New Cars: March 2024 - iSeeCars Study | |||

| Rank | Model | Average Days on Market | Average Price |

| 1 | Toyota Grand Highlander Hybrid | 14.2 | $55,224 |

| 2 | Mercedes-Benz G-Class | 18.7 | $206,737 |

| 3 | Land Rover Range Rover | 19.3 | $158,893 |

| 4 | Toyota Sienna Hybrid | 22.9 | $53,894 |

| 5 | GMC Canyon | 23.0 | $49,687 |

| 6 | Chevrolet Colorado | 23.8 | $42,158 |

| 7 | Toyota Grand Highlander | 24.4 | $52,933 |

| 8 | Cadillac Escalade | 26.2 | $110,947 |

| 9 | Toyota Highlander Hybrid | 28.3 | $50,646 |

| 10 | Toyota Corolla | 28.5 | $25,359 |

| 11 | Toyota Corolla Cross Hybrid | 29.0 | $34,428 |

| 12 | Toyota GR86 | 29.3 | $34,550 |

| 13 | Toyota Corolla Hatchback | 29.9 | $26,655 |

| 14 | Volvo XC40 Recharge | 30.2 | $59,532 |

| 15 | Toyota Prius Prime | 30.2 | $40,629 |

| 16 | Toyota Corolla Hybrid | 30.6 | $27,068 |

| 17 | Toyota Tacoma | 30.7 | $45,426 |

| 18 | Cadillac Escalade ESV | 31.0 | $113,986 |

| 19 | Lexus NX 250 | 31.0 | $43,788 |

| 20 | Toyota Corolla Cross | 32.5 | $30,860 |

| Overall Average | 54.0 | $44,476 | |

Interspersed among the logical Toyotas are three luxury SUVs, including the Mercedes-Benz G-Class, Land Rover Range Rover, and Cadillac Escalade, confirming common knowledge – affluent buyers aren’t letting macroeconomic concerns slow them down. One electric vehicle, the Volvo’s XC40 Recharge, makes the top 20 list.

“It’s interesting to see the Toyota Sienna Hybrid, GMC Canyon, and Chevrolet Colorado among the top 10 fastest-selling models,” said Brauer. “A minivan and two midsize pickups further illustrate the demand for practical vehicles to help new car buyers justify their purchase.”

The 10 Fastest-Selling New Electric Vehicles

EVs are among the slowest selling vehicles right now, but when broken out from overall new car sales we see the market again favoring compact and midsize SUVs, even when the powertrains involve motors and batteries.| 10 Fastest-Selling New EVs: March 2024 - iSeeCars Study* | |||

| Rank | Model | Average Days on Market | Average Price |

| 1 | Volvo XC40 Recharge | 30.2 | $59,532 |

| 2 | Chevrolet Blazer EV | 34.2 | $55,365 |

| 3 | Volvo C40 Recharge | 36.4 | $59,570 |

| 4 | Kia EV9 | 37.8 | $69,438 |

| 5 | Cadillac LYRIQ | 40.5 | $66,482 |

| 6 | Hyundai Kona Electric | 47.3 | $37,727 |

| 7 | BMW iX | 48.2 | $99,224 |

| 8 | Toyota bZ4X | 48.3 | $48,742 |

| 9 | BMW i5 | 52.1 | $82,847 |

| 10 | Hyundai Ioniq 5 | 55.5 | $52,433 |

| EV Average | 70.6 | $57,900 | |

“Nearly all of these electric vehicles cost more than $50,000, which puts them beyond the reach of most consumers,” said Brauer. “Until electric cars can compete with gasoline-powered models on price they will continue to sell at a slow rate and in small volumes.”

The 20 Slowest-Selling New Cars

All of the slowest-selling used cars take 90 or more days to sell, with the top-ranked Jeep Cherokee taking more than three times the 54-day average, at 169.7 days.| 20 Slowest-Selling New Cars: March 2024 - iSeeCars Study | |||

| Rank | Model | Average Days on Market | Average Price |

| 1 | Jeep Cherokee | 169.7 | $39,096 |

| 2 | Mercedes-Benz EQS (sedan) | 129.7 | $125,496 |

| 3 | GMC Acadia | 126.0 | $44,766 |

| 4 | Hyundai Santa Fe Plug-In Hybrid | 125.4 | $47,492 |

| 5 | Lincoln Navigator L | 123.3 | $103,764 |

| 6 | Infiniti QX55 | 111.5 | $53,482 |

| 7 | Infiniti QX80 | 110.1 | $83,109 |

| 8 | Lexus GX 460 | 107.3 | $66,008 |

| 9 | Ford Mustang Mach-E | 105.6 | $50,989 |

| 10 | Mercedes-Benz EQS (SUV) | 105.5 | $128,426 |

| 11 | Buick Enclave | 102.1 | $51,242 |

| 12 | Buick Envision | 97.7 | $39,661 |

| 13 | Lincoln Navigator | 97.4 | $101,957 |

| 14 | Chevrolet Bolt EUV | 93.9 | $32,245 |

| 15 | Lexus RZ 450e | 93.2 | $62,548 |

| 16 | Ford F-150 Hybrid | 91.6 | $65,262 |

| 17 | Genesis GV60 | 91.1 | $63,253 |

| 18 | Chevrolet Camaro (convertible) | 90.9 | $48,248 |

| 19 | Mazda CX-90 | 90.5 | $50,560 |

| 20 | Lincoln Nautilus | 90.3 | $57,408 |

| Overall Average | 54.0 | $44,476 | |

The 10 Slowest-Selling New Electric Vehicles

Taking between 81 and 130 days to sell, most of the slowest-selling electric vehicles have been available for only a few years, yet they can’t generate strong interest among new car buyers.“With the limited number of new electric models available we’re seeing most of them on either the fastest or slowest selling lists,” said Brauer. “Many of these models have seen reduced production in recent months due to slow sales.”

| 10 Slowest-Selling New EVs: March 2024 - iSeeCars Study* | |||

| Rank | Model | Average Days on Market | Average Price |

| 1 | Mercedes-Benz EQS (sedan) | 129.7 | $125,496 |

| 2 | Ford Mustang Mach-E | 105.6 | $50,989 |

| 3 | Mercedes-Benz EQS (SUV) | 105.5 | $128,426 |

| 4 | Chevrolet Bolt EUV | 93.9 | $32,245 |

| 5 | Lexus RZ 450e | 93.2 | $62,548 |

| 6 | Genesis GV60 | 91.1 | $63,253 |

| 7 | Nissan Ariya | 88.2 | $52,741 |

| 8 | Audi Q8 e-tron | 85.3 | $84,687 |

| 9 | Hyundai Ioniq 6 | 83.1 | $47,370 |

| 10 | Volkswagen ID.4 | 81.8 | $48,675 |

| EV Average | 70.6 | $57,900 | |

Days on Market for Used Cars

The 20 Fastest-Selling Used Cars

The fastest-selling used cars range between 12 to 25 days on market, below the used car average of 34.2 days and notably quicker than the new car average of 54 days.| 20 Fastest-Selling 1- to 5-Year-Old Used Cars: March 2024 - iSeeCars Study | |||

| Rank | Model | Average Days on Market | Average Price |

| 1 | Lexus RX 350h | 12.3 | $57,229 |

| 2 | Lexus NX 350h | 15.8 | $44,419 |

| 3 | Lexus NX 250 | 19.8 | $38,772 |

| 4 | Kia Niro Plug-In Hybrid | 20.0 | $24,276 |

| 5 | Lexus IS 500 | 21.4 | $59,489 |

| 6 | Toyota Highlander Hybrid | 21.4 | $39,409 |

| 7 | Lexus NX 350 | 21.6 | $43,328 |

| 8 | Toyota Corolla Hybrid | 21.8 | $23,016 |

| 9 | Mazda MX-5 Miata | 22.5 | $27,237 |

| 10 | Honda CR-V Hybrid | 22.9 | $31,591 |

| 11 | Ford Maverick Hybrid | 23.0 | $30,917 |

| 12 | Subaru Impreza | 23.4 | $19,990 |

| 13 | Hyundai Elantra N | 23.7 | $31,602 |

| 14 | Lexus ES 250 | 23.8 | $32,246 |

| 15 | Lexus RX 350 | 24.0 | $40,479 |

| 16 | Honda Accord Hybrid | 24.2 | $28,568 |

| 17 | Lexus IS 300 | 24.4 | $30,457 |

| 18 | Honda Odyssey | 24.9 | $32,568 |

| 19 | Kia Carnival | 25.0 | $34,706 |

| 20 | Lexus ES 350 | 25.1 | $34,244 |

| Overall Average | 34.2 | $31,920 | |

The prominence of hybrids, as well as a compact truck and two minivans, further validates the power of value paired with functionality.

“Most of the fastest-selling used models scream practical thinking, but the Mazda Miata and Hyundai Elantra N manage to bring a bit of fun to the value equation” said Brauer.

The 10 Fastest-Selling Used Electric Cars

All four of Tesla’s models are among the fastest-selling used EVs, with three of its cars in the top four slots. The recently introduced Rivian R1S is one of the most expensive used EVs you can buy, yet it edges out the Chevrolet Bolt EUV, which is one of the least expensive.“With an average price of $37,644, the fastest-selling used electric vehicles are $20,000 cheaper than the fastest-selling new EVs,” said Brauer. “This is the pricing gulf manufacturers need to bridge to engage mainstream new-car shoppers.”

| 10 Fastest-Selling 1- to 5-Year-Old Used EVs: March 2024 - iSeeCars Study | |||

| Rank | Model | Average Days on Market | Average Price |

| 1 | Tesla Model 3 | 26.2 | $29,154 |

| 2 | Tesla Model Y | 28.1 | $35,584 |

| 3 | Audi Q4 e-tron | 29.1 | $40,121 |

| 4 | Tesla Model X | 29.6 | $61,293 |

| 5 | Rivian R1S | 31.0 | $83,690 |

| 6 | Chevrolet Bolt EUV | 31.7 | $24,295 |

| 7 | Kia EV6 | 31.9 | $35,148 |

| 8 | Tesla Model S | 32.0 | $58,527 |

| 9 | MINI Hardtop 2 Door | 33.9 | $23,376 |

| 10 | Porsche Taycan | 34.6 | $86,738 |

| Used EV Average | 36.4 | $37,644 | |

The 20 Slowest-Selling Used Cars

These used models take between 56 and 150 days to sell, with premium brands making up 13 of the 20 slowest selling used cars.| 20 Slowest-Selling 1- to 5-Year-Old Used Cars: March 2024 - iSeeCars Study | |||

| Rank | Model | Average Days on Market | Average Price |

| 1 | Genesis GV60 | 149.9 | $53,986 |

| 2 | Chrysler Pacifica Plug-In Hybrid | 78.0 | $44,180 |

| 3 | Mercedes-Benz EQS (SUV) | 77.4 | $98,147 |

| 4 | Lincoln Corsair | 73.4 | $41,111 |

| 5 | Audi S8 | 70.2 | $79,400 |

| 6 | Maserati Ghibli | 69.8 | $43,870 |

| 7 | Hyundai Ioniq 6 | 69.7 | $37,635 |

| 8 | Hyundai Santa Fe Plug-In Hybrid | 65.6 | $37,275 |

| 9 | Audi RS 5 Sportback | 64.6 | $59,735 |

| 10 | Ford Escape Plug-In Hybrid | 63.2 | $28,731 |

| 11 | Mercedes-Benz EQE (sedan) | 63.2 | $72,596 |

| 12 | Audi RS Q8 | 62.5 | $100,000 |

| 13 | Maserati Quattroporte | 62.1 | $62,191 |

| 14 | Chrysler Voyager | 61.2 | $23,393 |

| 15 | Volvo S90 | 58.9 | $38,594 |

| 16 | Mercedes-Benz EQS (sedan) | 58.5 | $81,603 |

| 17 | Subaru Solterra | 58.4 | $37,738 |

| 18 | Volvo C40 Recharge | 57.5 | $39,124 |

| 19 | Audi R8 | 56.4 | $186,719 |

| 20 | Maserati Levante | 56.1 | $48,370 |

| Overall Average | 34.2 | $31,920 | |

The 10 Slowest-Selling Used Electric Cars

While slow to sell, many of these used EVs can be purchased for less than $40,000, making them a cost-saving alternative to a new car.| 10 Slowest-Selling 1- to 5-Year-Old Used EVs: March 2024 - iSeeCars Study | |||

| Rank | Model | Average Days on Market | Average Price |

| 1 | Genesis GV60 | 149.9 | $53,986 |

| 2 | Mercedes-Benz EQS (SUV) | 77.4 | $98,147 |

| 3 | Hyundai Ioniq 6 | 69.7 | $37,635 |

| 4 | Mercedes-Benz EQE (sedan) | 63.2 | $72,596 |

| 5 | Mercedes-Benz EQS (sedan) | 58.5 | $81,603 |

| 6 | Subaru Solterra | 58.4 | $37,738 |

| 7 | Volvo C40 Recharge | 57.5 | $39,124 |

| 8 | Ford Mustang Mach-E | 52.8 | $36,336 |

| 9 | Nissan LEAF | 52.0 | $17,508 |

| 10 | Hyundai Kona Electric | 50.9 | $23,070 |

| Used EV Average | 36.4 | $37,644 | |

Methodology

iSeeCars analyzed over 463,000 new and used car sales (1- to 5-year-old used cars) from March 2024. The number of days that each car was listed for sale on iSeeCars.com was aggregated at the model level, and the average days on market for each was mathematically modeled. Heavy-duty vehicles, models no longer in production prior to the 2023 model year (for used cars), and low-volume models were excluded from further analysis.

About iSeeCars.com